Quicken Overview

Quicken is a personal finance management software developed by Intuit, which is now owned by H.I.G. Capital. It’s designed to help individuals and small businesses manage their financial transactions, track expenses, create budgets, and plan for the future.

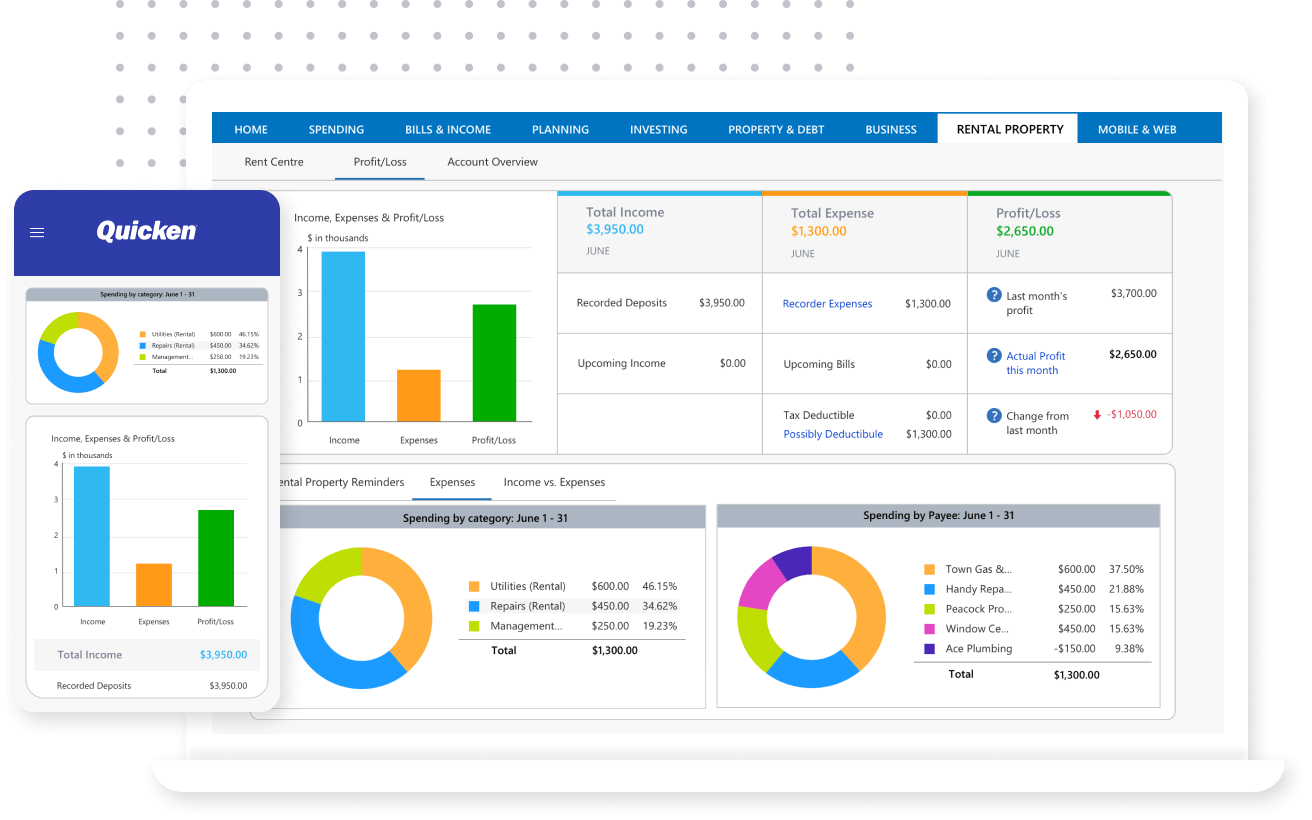

- Account Tracking: Quicken allows users to link their bank, credit card, investment, and other financial accounts. It automatically pulls in transaction data, providing a comprehensive view of their financial situation.

- Budgeting: Users can create budgets based on their income and expenses. Quicken can track spending in various categories and help users stay on target with their financial goals.

- Investment Management: Quicken can track and analyze investments, including stocks, bonds, and mutual funds. It provides tools for monitoring portfolio performance and evaluating investment strategies.

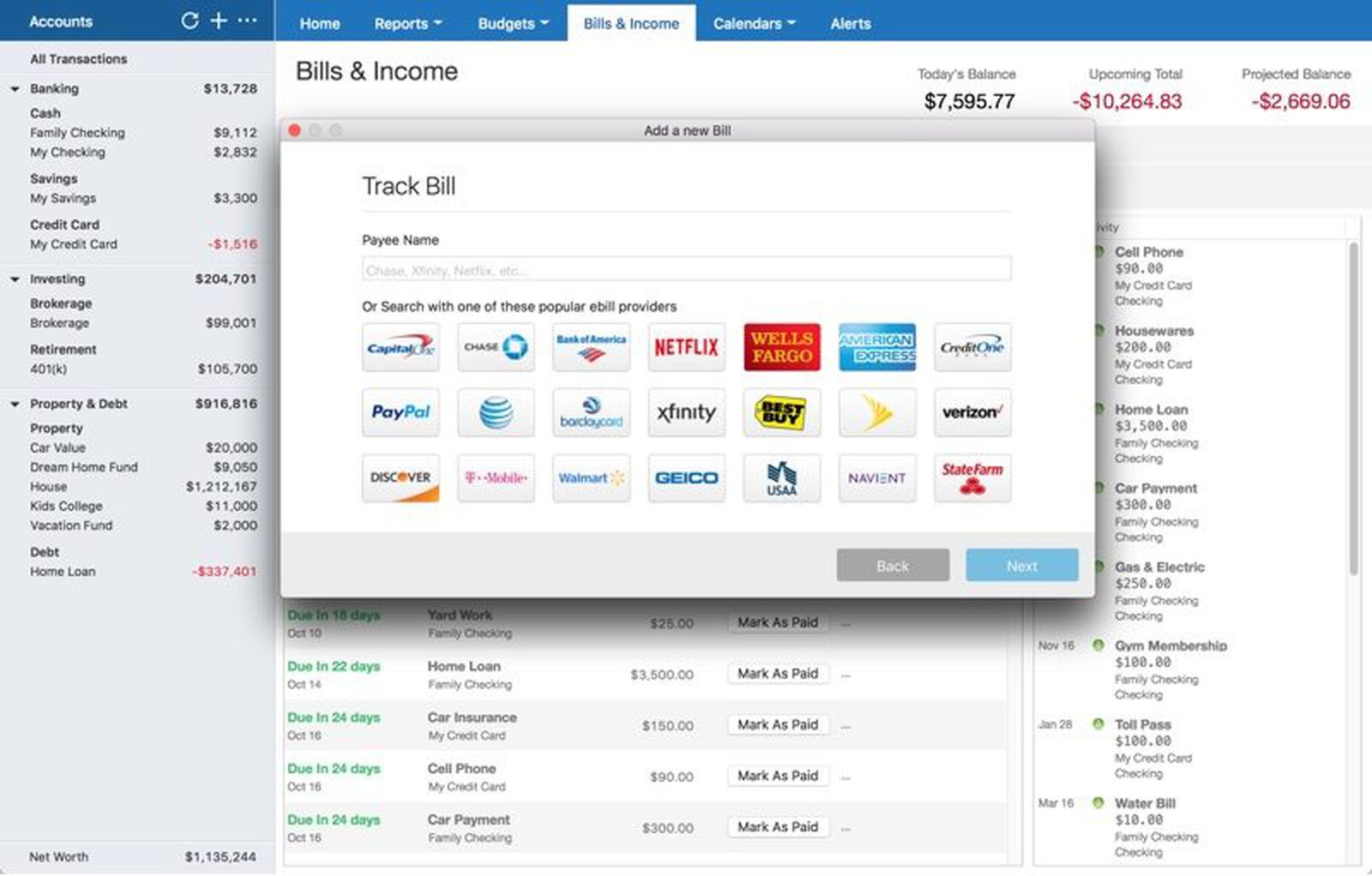

- Bill and Expense Management: Users can set up reminders for bills and track recurring expenses. This helps in avoiding late payments and managing cash flow effectively.

- Tax Planning: Quicken provides tools to help users estimate their tax liability and plan for tax-related expenses.

- Reports and Graphs: It offers a variety of reporting options to visualize financial data. Users can generate income statements, balance sheets, and other reports to gain insights into their financial health.

- Debt Reduction Planner: This feature helps users develop a plan to pay down debt efficiently.

- Property and Asset Tracking: Quicken can help users keep track of the value of their assets, including real estate and other valuable possessions.

- Mobile App: Quicken offers a mobile app, that allowing users to access their financial data on the go.

- Data Security: Quicken employs encryption and other security measures to protect users’ financial information.

Quicken Products

- Quicken Starter: This is the basic version of Quicken . It helps users track their spending, create budgets, and manage their bills. It also allows users to see all their accounts in one place.

- Quicken Deluxe: This version includes all the features of Quicken Starter, with additional tools for managing savings goals, investments, and property value tracking.

- Quicken Premier: This version is designed for individuals who have investments. It includes features to help users track and optimize their investment portfolio.

- Quicken Home & Business: This version is suitable for small businesses and individuals who need to manage both personal and business finances. It includes features for invoicing, expense tracking, and business reporting.

Quicken Customer Services

- Support Website: Quicken provides a support website where users can find answers to frequently asked questions (FAQs), browse troubleshooting articles, and access user guides.

- Community Forums: Quicken has an online community forum where users can ask questions, share tips, and connect with other Quicken users for assistance.

- Live Chat: Depending on availability, users may have the option to engage in live chat with a Quicken support representative through the website.

- Phone Support: Quicken typically offers phone support where users can speak directly with a customer service representative. They can provide guidance on various issues or concerns.

- Email Support: Users may have the option to send an email to Quicken support for assistance. Response times may vary.

- Social Media: Quicken may have a presence on social media platforms like Twitter or Facebook, where users can reach out for support or updates.

- Product Updates and Newsletters: Users might receive updates and newsletters from Quicken via email, which can include important information and tips.

Quicken Benefits, Features And Advantages

Benefits:

- Comprehensive Financial Overview: Quicken provides a centralized platform to track all your financial accounts, giving you a clear and comprehensive view of your financial situation.

- Streamlined Expense Tracking: It helps users monitor and categorize expenses, making it easier to identify spending patterns and areas where adjustments can be made.

- Budgeting and Planning Tools: Quicken enables users to create budgets, set financial goals, and track progress towards achieving them.

- Investment Management: It offers tools for tracking and analyzing investments, helping users make informed decisions about their portfolio.

- Bill Payment Reminders: Quicken can notify users of upcoming bills and help avoid late payments.

- Tax Planning Assistance: It provides tools to help users estimate tax liabilities and prepare for tax-related expenses.

Features:

- Account Integration: Quicken can connect to various financial institutions, allowing for automatic synchronization of transaction data.

- Reporting and Graphs: Users can generate a variety of reports and visual representations of their financial data to gain insights into their financial health.

- Property and Asset Tracking: Quicken allows users to keep track of the value of their assets, including real estate and valuable possessions.

- Investment Analysis and Tracking: It offers tools to evaluate the performance of investments and assess their impact on overall financial health.

Advantages:

- Time Savings: Quicken automates the process of tracking financial transactions, saving users time compared to manual record-keeping.

- Financial Awareness: By providing a clear overview of income, expenses, investments, and debts, Quicken helps users become more aware of their financial situation.

- Goal Achievement: The budgeting and planning tools in Quicken assist users in setting and achieving their financial goals.

- Security and Privacy: Quicken employs encryption and other security measures to protect users’ financial information.

Experts of Quicken

- Quicken provides a comprehensive set of personal finance tools, including budgeting, expense tracking, and investment management.

- The platform offers automatic transaction syncing with various financial institutions, making it convenient for users to manage multiple accounts in one place.

- Quicken allows users to generate detailed reports and create customized financial goals to track progress over time.

- The software provides timely reminders for bill payments and has features to help users optimize their tax deductions.

Quicken Conclusion

In conclusion, Quicken is a powerful personal finance management tool that offers a range of features and benefits to help individuals and small businesses effectively manage their finances. Its capabilities include comprehensive account tracking, budgeting tools, investment management, bill payment reminders, tax planning assistance, and more.

By providing users with a centralized platform to monitor their financial transactions, Quicken enables a deeper understanding of spending habits and financial health. The software’s reporting and graphing features offer valuable insights, while its investment analysis tools assist in making informed decisions about investments.